If you are a client of

Pristine Loss Mitigation (“Pristine”), you may have received a letter in the last couple of months advising you that the company is closing their doors and transferring cases to another entity,SCC

Law Group (“SCCLG”). Business Consumer Alliance (“BCA”) recently became aware of this through consumers who received notifications from Pristine claiming their previous attorney, Thomas J. Parrott, left the company, which forced them to close their doors.

The notification goes on to say that SCCLG will be conducting reviews of the client cases received from Pristine and urges clients to contact SCCLG to set up an appointment to enter into a new agreement with SCCLG. Some reviewers have reportedly been told

by Pristine that fees they paid for services will be credited to their SCCLG case, although many clients believe SCCLG will request more fees before fulfilling promised services by Pristine.

Pristine advertised loan modification and mortgage relief services. Complaints received by BCA typically claim that clients are required to pay advance fees to stop foreclosure, obtain loan modifications, or other debt relief services. After paying thousands

of dollars to Pristine to help save their home, complainants state they didn’t get the promised results. Some complainants also allege that they repeatedly were asked to send in the same paperwork several times, phone calls and emails went unanswered, and

at times the company came back requesting more up-front money to solve their foreclosure problems. An Illinois client claims her lender never heard from Pristine, even after the client paid the company $4,000 up-front to lower their mortgage payments. Sadly,

the customer couldn’t obtain a refund to help save their home from foreclosure. BCA has given Pristine an F rating, due to complaint allegations and its failure to address complaints.

SCCLG appears to be a new outfit that advertises similar services. While the

website asserts SCCLG has been in business for over five years, their business filing with Riverside County and the web creation date records the company started business in March 2014. Reviewers have said some of Pristine’s employees are now working as

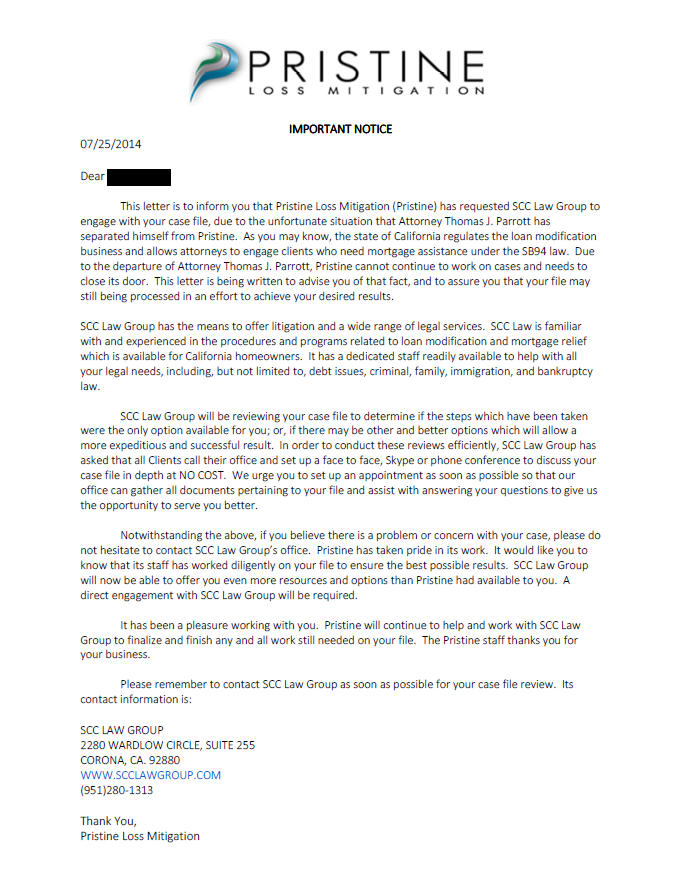

SCCLG. While this company currently has no complaints, time will only tell if they are successful in picking up where Pristine left off. Below is a sample letter clients have been receiving from Pristine (click to enlarge):

The Federal Trade Commission’s (“FTC”) MARS Rule makes it illegal for companies offering mortgage assistance relief services to collect any fees, regardless of the form, until it provides a written offer for a loan modification or other relief from your

lender and you accept the offer, along with other conditions. Under the same rule, attorneys who offer mortgage relief services can require an advance fee ONLY if they are: licensed to practice law in the state where you live or where your house is located;

providing you with real legal services and providing mortgage assistance relief services as part of the practice of law; complying with state ethic requirements for attorneys; placing the money in a client trust account, withdrawing fees only as they complete

actual legal services, and notifying you of each withdrawal.

Before you hire a firm or anyone claiming to be an attorney, do your research. Check to ensure they are properly licensed and that there is no disciplinary action against them. Ask what their expertise or specialty in law is and if they have ever provided

foreclosure relief services. Also ask about their track record in providing relief services to their customers.

Avoid any business or individual offering mortgage relief services that:

- guarantees to stop the foreclosure process, no matter what your circumstances are; and/or guarantees they can obtain a loan modification for you;

- advises you to stop making your mortgage payments;

- instructs you not to contact your lender, attorney, or credit/housing counselor;

- collects fees before providing any services or only accepts payment by wire transfer or cashier’s check;

- pressures you to sign papers before you are able to review the terms and conditions or before you have time to thoroughly read and understand the agreement.

Clients who wish to

file a complaint against Pristine can do so through BCA. BCA has a long history of working with state and federal government agencies and frequently communicates with them relaying information provided from complaints and information provided by the public.

If you have been affected by any other scam or have a problem with a business, you are welcome to file a complaint with BCA.

Separate

reports on Pristine and

SCCLG are available on the Business Consumer Alliance website.

About the Author

Nicole Pitts is a Senior Business Analyst and Editor for Business Consumer Alliance. She has been with the organization for 12 years and specializes in report writing, business evaluation, and investigations. Nicole corresponds with businesses regarding

complaint trends and provides suggestions to help them alleviate problem areas that may cause concern. She also conducts advertisement reviews, reports on government enforcement actions, and assists government agencies in obtaining information. She enjoys

reading, movies, and spending time with her family. Nicole can be reached by email at npitts@businessconsumeralliance.org.